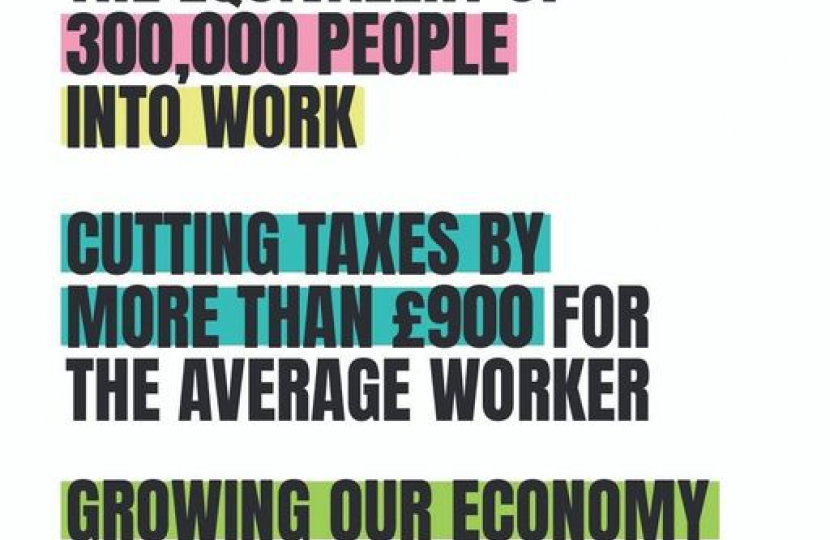

I know the past few years have been a difficult time for families and for our economy. Today's budget shows that because of the progress we have made - inflation has more than halved, wages are growing, and energy prices are falling - we can now afford further tax cuts and put money back into the pockets of hardworking families.

Today's measures include:

- A FURTHER 2% cut to National Insurance. Taken with the cut that took effect in January, this is a tax cut of £1,800 a year for a couple on average incomes.

- Supporting half a million families by raising the threshold and halving the rate at which Child Benefit is withdrawn - worth £1,260 a year for some parents.

- Freezing Fuel Duty for the 14th year and extending the 5p cut to limit prices at the pump.

- Extending the Household Support Fund for another 6 months to provide £500m of support those on low incomes.

- Abolishing the non-dom tax status to raise £2.7bn.

- Freezing Alcohol Duty to ease the pressure on the hospitality sector.

- 15 new specialist free schools for children with SEND - including 80 new spaces in Horsham.

- A massive, multi-billion pound productivity plan for the NHS and other public services, saving time for NHS staff and saving the taxpayer money.

- £1 billion for renewable energy at our next auction round, £1 billion funding for Green Industries, and the next stage of our programme for nuclear Small Modular Reactors.

And Surrey got a shout-out - the Chancellor announced that the Government has finalised our devolution deal, giving Surrey County Council more powers to make decisions that are best for our area.